Paul B Insurance Things To Know Before You Buy

Wiki Article

A Biased View of Paul B Insurance

Table of ContentsWhat Does Paul B Insurance Do?Fascination About Paul B InsuranceThe Buzz on Paul B InsurancePaul B Insurance for BeginnersSome Ideas on Paul B Insurance You Should Know

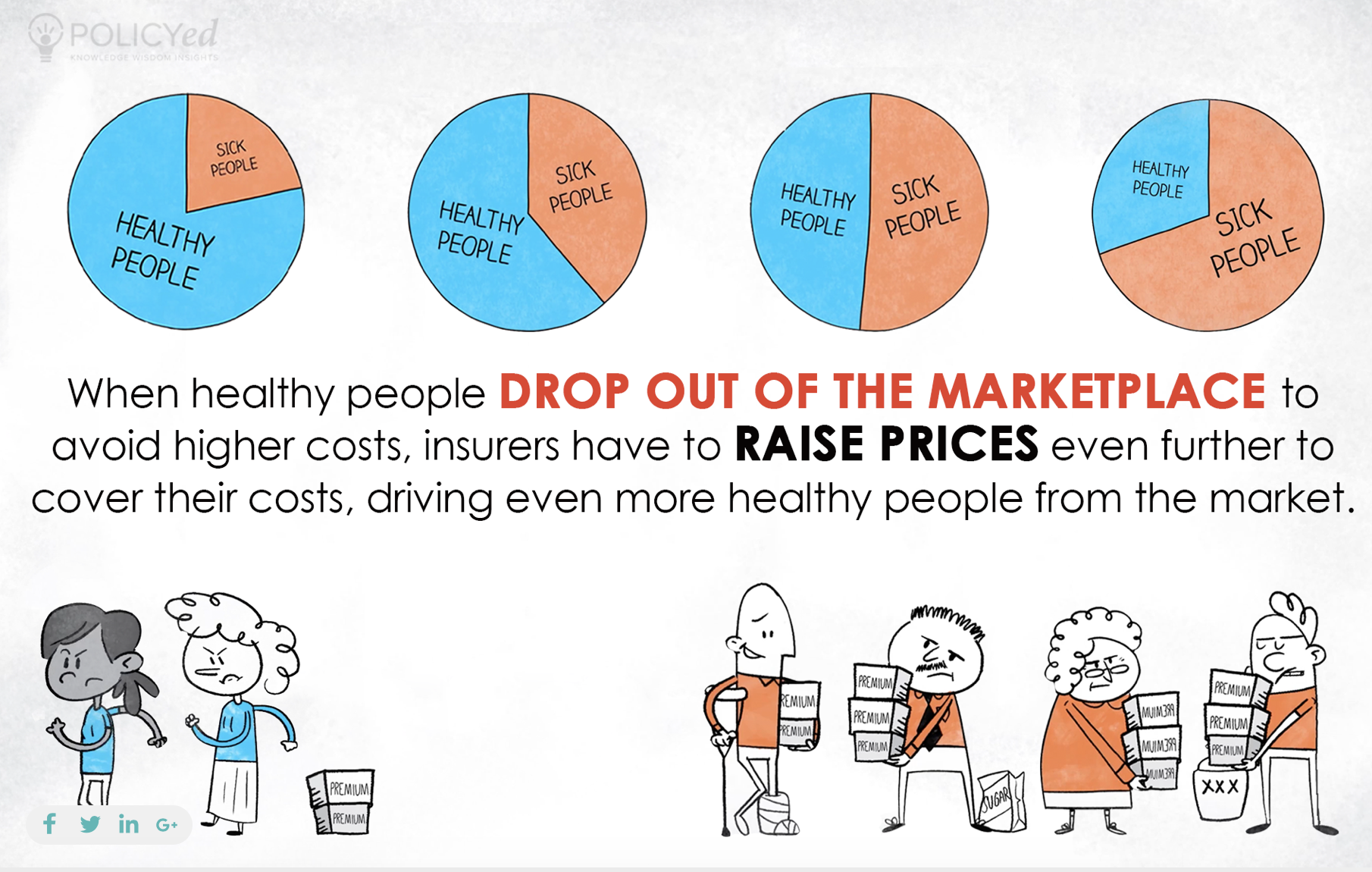

Today, resident, cars and truck proprietors, services as well as institutions have offered to them a vast array of insurance coverage items, much of which have become a requirement for the performance of a free-enterprise economic situation. Our culture could hardly function without insurance. There would so much unpredictability, a lot direct exposure to abrupt, unanticipated possibly devastating loss, that it would be hard for any person to plan with self-confidence for the future.The larger the variety of costs payers, the extra properly insurers have the ability to approximate potential losses thus compute the quantity of costs to be gathered from each. Because loss occurrence might alter, insurance companies remain in a continuous process of gathering loss "experience" as a basis for regular reviews of premium needs.

In this respect, insurers perform a funding formation function similar to that of banks. Thus, business enterprises obtain a dual gain from insurancethey are enabled to operate by transferring potentially crippling risk, as well as they likewise may acquire funding funds from insurance companies with the sale of stocks and bonds, for instance, in which insurers spend funds.

For a lot more on the insurance sector's contributions to society and also the economic climate see A Firm Structure: How Insurance Sustains the Economy.

Paul B Insurance Fundamentals Explained

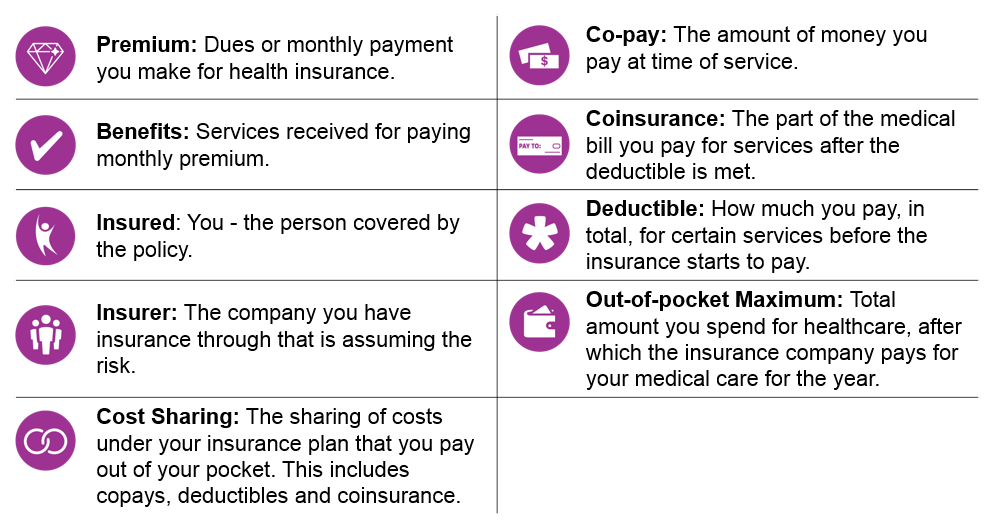

Being aware of what's offered as well as exactly how it functions can have a major impact on the price you will certainly pay to be covered. Equipped with this expertise, you'll be able to pick the ideal plans that will certainly protect your way of living, properties, and building.When you have something to shed, as well as you can not afford to pay for a loss yourself, you spend for insurance. By paying money each month for it, you get the assurance that if something fails, the insurer will pay for things you need to make life like it was before your loss.

The insurance policy company has many customers. When a loss happens, they may get insurance money to pay for the loss.

Some insurance is extra, while other insurance policy, like vehicle, might have minimum requirements set out by law. Some insurance policy is not needed by legislation. Lenders, banks, and also home mortgage business will need it if you have actually borrowed cash from them to make an acquisition worth a great deal of money, such as a residence or a cars and truck.

Top Guidelines Of Paul B Insurance

You will certainly need car insurance policy if you have an auto loan and also home insurance policy if you have a mortgage. It is commonly needed to certify for a financing for large acquisitions like residences. Lenders intend to ensure that you are covered versus risks that might create the value of the automobile or residence to decline if you were to experience a loss prior to you have actually paid it off.This is not a good concept. Lending institution insurance is a lot more pricey than the policy you would get by yourself. Some companies may have discount rates tailored at generating particular types of clients. Exactly how well your account fits the insurance firm's profile will factor into how great your rate will be.

Various other insurance providers may produce programs that provide bigger price cuts to senior citizens or members of the military. There is no other way to know without looking around, comparing plans, and also obtaining quotes. There are 3 major reasons that you must get it: It is needed by legislation, such as obligation insurance coverage for check my blog your auto.

An economic loss might be beyond what you could afford to pay or recoup from conveniently. For example, if you have expensive computer equipment in your apartment, you will certainly intend to purchase renters insurance policy. When lots of people assume regarding personal insurance policy, they are likely thinking concerning one of these 5 significant types, amongst others: Residential, such as house, apartment or co-op, or tenants insurance.

What Does Paul B Insurance Mean?

, which can drop right into any of these Learn More groups. It covers you from being sued if one more individual has a loss that is your mistake.Insurance requires licensing as well as is split right into teams. This means that before someone is lawfully enabled to market it or provide you with guidance, they should be certified by the state to sell and provide guidance on the kind you are getting. For example, your house insurance coverage broker or representative might inform you that they do not use life or handicap insurance policy.

If you're able to buy more than one kind of policy from the same individual, you might be able to "pack" your insurance policy as well as get a discount rate for doing so. This includes your main house along with any various other structures in the area. You can locate standard health advantages along with various other health and wellness plans like dental or long-lasting treatment.

Paul B Insurance Can Be Fun For Everyone

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

If you obtain an actually low cost on a quote, you need to ask what sort of plan you have or what the restrictions of it are. look at this site Compare these details to those in various other quotes you have. Plans all contain specific sections that detail limits of amounts payable. This applies to all sort of plans from health and wellness to vehicle.

Inquire about what insurance coverages are minimal as well as what the limits are. You can often request the kind of plan that will certainly supply you greater restrictions if the limits displayed in the policy issue you. Some sorts of insurance coverage have waiting periods before you will be covered. With oral, you might have a waiting duration.

Report this wiki page